After navigating to the Chart of Accounts, the undeposited funds account can be created as a current asset. This practice is crucial for accurately reflecting the financial status of the business and ensuring that all transactions are accounted for in a timely manner. Timely deposits help in preventing discrepancies and errors and ensure that the financial records are in line with the regulatory requirements. We will discuss the benefits of using undeposited funds, such as improved financial management, easier reconciliation, and more accurate reporting. To ensure you are equipped with the best practices for managing undeposited funds, we will cover essential tips for regular reconciliation, proper categorization, and timely deposits. By the end of this article, you will have a comprehensive understanding of undeposited funds in QuickBooks and the tools needed to manage them effectively.

Mistake 3: Not Reconciling Undeposited Funds Regularly

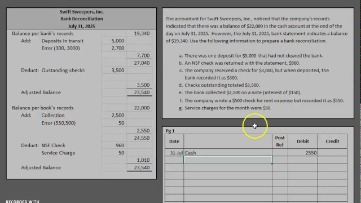

Some accountants or bookkeepers who don’t understand the full backflush costing financial definition of backflush costing functionality of QuickBooks Online might try to fix incorrect balances in the Undeposited Funds account with a journal entry. Although this will remedy the incorrect account balance on the balance sheet, it will not clear the undeposited transactions from the Bank Deposit screen. Here’s what you need to know about QuickBooks Online’s Undeposited Funds account to keep your business accounting operations running smoothly. When you deposit the payments together at the bank, you record that in QuickBooks as well. I understand that you’re looking to clear out or deposit undeposited funds. Let me share some insights on how to clear it out and how undeposited funds work in QuickBooks Online.

For example, let’s say Willie’s Widgets paid you $300, Wally’s Whatsits paid you $750 and Whitley’s Whosits paid you $200. However, you need to properly credit each customer for their payment. Posting each payment to the Undeposited Funds account and then recording the deposit in QuickBooks Online allows you to do this. In order for your financial statements to be accurate for the year, you need to record the payment as being received on Dec. 31. However, the payment will not clear your bank until Jan. 2 of the next year, at the earliest. QuickBooks Online has a special account specifically for these funds in transit.

Reasons to use the Undeposited Funds account

In Quickbooks Desktop, the undeposited funds account is a default feature, while in Quickbooks Online, users have the flexibility to choose whether to use this account. Moving money from undeposited funds in Quickbooks Online involves creating bank deposits and transferring the funds from the undeposited account to the appropriate bank account within the system. Some QuickBooks Online users prefer to post payments straight to their bank accounts rather than using the Undeposited Funds account. This feature ensures that funds are not prematurely recorded as income, providing a more precise representation of the company’s financial status. By centralizing incoming payments, it streamlines the reconciliation process, simplifying the identification of discrepancies and minimizing errors. Setting up undeposited funds in Quickbooks Online involves accessing the accounting settings and configuring the undeposited funds account to ensure accurate recording of financial transactions.

Step 4: Reconcile the Undeposited Funds Account

This is different from petty cash or your cash register till, which is cash you have on hand but don’t intend to deposit. As you can see in the image above, QuickBooks Online instructs you to use the Cash On Hand account instead of the Undeposited Funds account for petty cash. Next, select the payments to include in the deposit from the non-gaap earnings definition undeposited funds list. I’ve got some ideas on when the money will be transferred to your business checking account, @NikkiB73. Moving funds from your undeposited account into your bank is simple and easy. Ultimately, these adjustments play a critical role in maintaining the financial accuracy and reliability of the organization’s records.

Continue entering payments received from your customers until all payments have been entered. You received the check on the last day of the year, which happened to be a Saturday. If you have any questions left and some other features to discover in QuickBooks, you probably have a lot of transactions and it is the situation when accounting integration like Synder can be of great assistance. The software provides an automatic sync of your clients’ transactions with QuickBooks Online or Desktop version reducing manual bookkeeping and accounting processes and making your reconciliation process impeccable . When processing invoice payments through QuickBooks Payments for Desktop, QuickBooks takes care of everything and there’s no need to combine payments or move them to the Undeposited Funds Account.

As it goes with all the software, there’s always a demanding learning curve. In other words, with more experience the tasks are done quicker and easier. So it makes sense to read or watch some tutorials when it comes to functions. Let’s look closer at what the Undeposited Funds Account in QuickBooks is. Accurate categorization facilitates the reconciliation process, simplifying the identification of any discrepancies and contributing to overall financial transparency and compliance.

It enhances transparency and accountability in financial management, contributing to overall business stability and growth. Moving funds from the Undeposited funds to your bank is for recording purposes only. Otherwise, you run the risk of either understating samsung galaxy s20 is too damn expensive or overstating your income, both of which will have tax implications.

- Undeposited funds help in aligning cash flow management, allowing for better forecasting and strategic decision-making.

- However, if you connect your bank and credit card accounts to QuickBooks, it automatically downloads all your transactions.

- Once the selections are made, verify the details and click ‘Save and Close’ to complete the bank deposit.

It’s possible that you’ve seen it many times without knowing much about it, or when you should use it. Well, get ready to learn something new and take a thorough look at Undeposited Funds. Again, make sure you are selecting Undeposited Funds from the “Deposit To” drop-down menu, and save the transaction. If a customer paid with a check or their payment comes with a reference number, you can record that information in QuickBooks as well.

It helps in identifying discrepancies between recorded and actual deposits, thus ensuring that all income is accurately reflected in the financial statements. Timely reconciliation can improve cash flow management by promptly identifying any delays or errors in the deposit process. This proactive approach also enhances the overall accuracy and reliability of financial reports, providing a solid foundation for informed decision-making and financial planning.